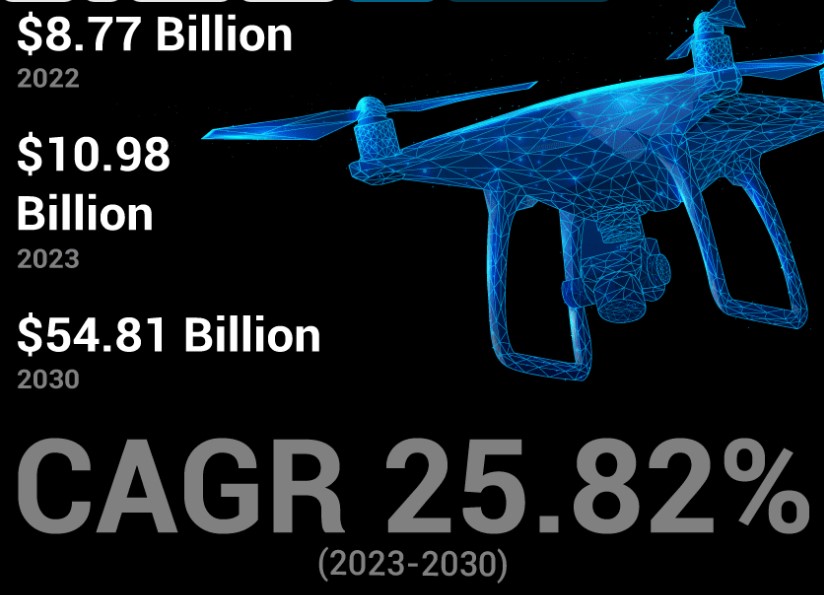

The global commercial drone market size was valued at USD 8.77 billion in 2022. The market is projected to grow from USD 10.98 billion in 2023 to USD 54.81 billion by 2030, exhibiting a CAGR of 25.82% during the forecast period. A drone, also known as an unmanned aerial vehicle, is a flying device, equipped with a camera and sensor. Different industries are investing in drone technology and trying to increase their awareness regarding the advantages of using drones in commercial applications.

Moreover, many firms are investing in startups to address the need for drone portfolios such as air taxis, surveying, logistics, monitoring, surveillance, and mapping. These factors are aiding market augmentation. This information is provided by Fortune Business Insights, in its report titled, “Commercial Drone Market, 2023-2030.”

Informational Source:

Report Coverage:

The report provides valuable insights into drivers, restraints, opportunities, and threats influencing market dynamics and valuation. The market is studied exhaustively by dividing it into segments and regions. Market share and valuation of each segment and region is also given in the report. Moreover, recent developments undertaken by key companies are also documented in the report.

List of Key Players Mentioned in the Report:

- 3D Robotics, Inc. (U.S.)

- Aeronavics Ltd. (New Zealand)

- AeroVironment Inc. (U.S.)

- Autel Robotics (China)

- Ehang Holdings Limited (China)

- FLIR Systems, Inc. (U.S.)

- Teal Drones (U.S.)

- Holy Stone (China)

- Intel Corporation (U.S.)

- AgEagle Aerial Systems Inc. (U.S.)

- Parrot Group (France)

- PrecisionHawk, Inc. (U.S.)

- Skydio, Inc. (U.S.)

- SZ DJI Technology Co., Ltd. (China)

- Yuneec Holding Ltd (China

Segments:

2ks Segment to Lead Backed by Growing Adoption in Photography and Mapping Sectors

As per weight, the market is split into <2Kg, 2Kg – 25Kg, and 25Kg – 150Kg. Among these, the <2Kg segment held the major market share in 2022 owing to the rising adoption of small drones for various applications such as photography, filming, mapping, inspection, and surveying.

Ease of Use and Economical Cost of Remote Operated Drone Facilitated Segment Growth

Based on technology, the market is divided into fully autonomous, semi-autonomous, and remote operated. Among these, the remote operated segment led the market in 2022. The ease of use and lower cost of remote operated drones as compared to other alternatives have contributed to segment proliferation.

Hardware Segment to Dominated Stoked by Increased Demand for Medical Drones

According to system, the market is bifurcated into hardware and software. Among these, the hardware segment is further divided into propulsion system, payload, airframe, and others. The hardware segment accounted for the largest market share in 2022. The surging demand for medical drones during the COVID-19 pandemic to deliver medicines and vaccines to rural areas facilitated the segment expansion.

Filming & Photograph Segment to Capture Largest Share Due to Easy Availability of Drones

Based on application, the market is split into filming & photography, mapping and surveying, horticulture and agriculture, inspection and maintenance, delivery and logistics, surveillance & monitoring, and others. Among these, the filming & photography segment accounted for the largest market share in 2022. The rising procurement of drones such as PowerVision PowerEgg X Wizard, Autel EVO II (With 8K video), DJI Mavic 2 Zoom, Parrot Anafi FPV, and many others with ease is expected to fuel segment growth.

Geographically, the market is segregated into North America, Europe, Asia Pacific, and the Rest of the World.

Drivers and Restraints:

Intetgration of Artificial Intelligence and Advanced Technologies to Bolster Market Growth

Technological breakthroughs in electronics, such as microcontrollers, processors, mobile hardware, cameras, and modern computing, have modernized the product line for commercial drones. Moreover, these advancements enable businesses to build in-house annotation and measurement tools for calculating volume, distance, and area. As a result, enterprises worldwide are demanding the integration of machine learning and artificial intelligence solutions to extract accurate results from vast amounts of data available, thus aiding the commercial drone market growth.

On the other hand, limited number of skilled drone pilots, lack of appropriate infrastructure, and uniform air traffic management regulations across different countries will hamper market proliferation in the forthcoming years.

Regional Insights:

North America captured majority of the commercial drone market share in 2022, owing to the presence of leading drone manufacturers in the U.S. and growing adoption of commercial drones. As per the Federal Aviation Administration FAA, 872,694 drones were registered in the U.S. in May 2021.

The Europe market is projected to grow substantially owing to rising use of drones for commercial applications in France, U.K., and Germany.

The Asia Pacific market is anticipated to grow significantly in the forthcoming years due to the growing number of drone manufacturers and operators in the region. This rise is owing to the rising investments in drone technology by OEMs and governments in the region.

Competitive Landscape:

Leading Companies Sign Collaboration Deals to Hold Significant Market Share

Industry leaders often make strategic moves to maximize profits to earn larger revenues. In some cases, they join other players in research and development to unveil new products and develop new technologies to meet changing requirements. For example, in October 2021, FIXAR, a leading commercial drone design and software developer signed an exclusivity agreement with Paras Aerospace, for FIXAR unmanned solution distribution in India. The companies will join forces to ensure access to cost-effective and efficient drones such as the FIXAR INDOOR and Fizar 007 in the Indian market.

Key Industry Development:

Feb 2022 – Zain Group, a Kuwait-based telecommunication services provider, signed an agreement to develop drone technologies with Saudi Arabia. The partnership will help diversify Saudi Arabia’s economy from oil and gas sector, considering a major percentage of Saudi Arabia’s economy runs due to oil exports.